Construction-to-permanent loans versus construction-only loans which is right for your project in 2025

You will not find a universal answer when choosing between a construction to perm loan and a construction-only loan. Your project’s needs, finances, and risk tolerance will guide your decision. Construction to perm loans offer a single closing, while construction-only loans require two. Cost, convenience, and the right fit differ for each. In 2025, construction loan rates range from about 6.8% to 13.8%. Mortgage rates have stayed high since 2023:

Year | Average 30-Year Fixed Mortgage Rate (%) |

|---|---|

2023 | |

2024 | ~6.7 |

2025 | ~6.8 |

Understanding these construction loan options helps you make a smart choice in today’s market.

Key Takeaways

Construction-to-permanent loans put building and mortgage together. You only need one closing. This saves you time and money.

Construction-only loans need two closings. They give you more choices. But they cost more and need more paperwork.

You can lock your interest rate early with a construction-to-permanent loan. This keeps you safe if rates go up while building.

Pick construction-to-permanent loans if you want things simple and have strong finances. Choose construction-only loans for harder projects or if you want more control.

Always plan for extra costs. Set aside a contingency fund. This helps you avoid surprises during building.

Key Differences

When you look at construction-to-permanent loans and construction-only loans, you will notice some big differences. These differences change how much you pay, how the process works, and how easy it is to handle your project. Knowing these main differences helps you pick the best construction loan for what you need.

Here is a table to help you compare the main features:

Feature | Construction-to-Permanent Loan (One Time Close Construction Loan) | Construction Loan (Construction-Only Loan) |

|---|---|---|

Number of Closings | 1 (single closing) | 2 (construction and permanent) |

Closing Costs | Lower (pay once) | Higher (pay twice) |

Appraisals | 1 | 2 |

Rate Lock | Yes, often at start | No, must re-qualify and lock later |

Process | Simple, streamlined | More complex, more paperwork |

Transition to Mortgage | Automatic after construction | Must apply for new mortgage |

Borrower Profile | Strong credit, higher down payment, detailed plans | Flexible down payment, may suit complex projects |

Best For | Simplicity, cost savings, stable finances | Flexibility, unique or complex builds |

Construction-to-Permanent Loan

A construction-to-permanent loan, also called a one time close construction loan, gives you money to build and then turns into a regular mortgage. You only fill out one application and go to one closing. This makes things easier and less stressful.

You pay closing costs just one time. This can help you save a lot of money compared to paying twice.

You only need one appraisal. This means you do not have to worry about a second appraisal being lower.

You can lock in your interest rate at the beginning. This keeps your rate safe if rates go up while you build.

You do not have to apply for a new mortgage after building. Your loan changes to a regular mortgage automatically.

Tip: If you want things to be simple and want to save on fees, a construction-to-permanent loan could be the best choice.

Lenders usually give construction-to-permanent loans to people with strong credit, steady income, and low debt. You often need a down payment of 20% or more, but you can use land equity if you already own the land. You must show your building plans and budget. This loan is good if you want to get your money set up early and avoid surprises.

Construction Loan

A construction loan, sometimes called a construction-only loan, only covers the building part. You need to get a new mortgage after the building is done. This means you have two closings and pay closing costs two times.

You pay more in closing costs because you pay at both closings.

You need two appraisals, which can be risky if the second one is lower.

You do not get to lock in your mortgage rate at the start. If rates go up, your final mortgage could cost more.

You must apply for a new mortgage after building. If your money situation changes, you could have problems.

Some people pick a construction loan for more choices. You might want this if you want to look for better mortgage rates after building or if your project is tricky and needs special money help. Lenders might let you pay a smaller down payment, but you still need good credit and steady income.

Note: A construction loan can be good if you want more control over your final mortgage or if you think your money will get better before building is done.

Who Each Loan Type Is Best For

Pick a construction-to-permanent loan if you want things to be simple and can meet higher credit and down payment rules.

Choose a construction loan if you need more choices, have a tricky project, or want to look for mortgage rates after building.

By knowing these main differences, you can pick the construction loan that fits your project and money goals in 2025.

How Each Loan Works

Construction-to-Permanent Loans

If you pick a construction-to-permanent loan, you get one loan for both building and paying for your home later. You only have to close once. This makes things easier and helps you save money on closing costs. You also lock in your interest rate at the start, so you do not worry if rates go up while building.

First, you get prequalified. The lender checks your credit, income, and builder’s background.

Next, you give your building plans, blueprints, and cost estimates.

The lender looks at your papers and says yes or no before building starts.

While building, you get money in steps. The lender checks the work before each payment.

You pay interest only on the money you use during building.

When building is done, the loan turns into permanent financing. You start paying both principal and interest each month.

Most construction-to-permanent loans need about 20 percent down. Lenders want to see good credit and clear plans. You cannot borrow more if you go over budget, so plan carefully. Some risks are building delays, spending too much, or changes in your money before the loan becomes permanent. Interest rates for construction loans are higher than regular mortgages because lenders take more risk.

Tip: Always keep extra money for surprise costs during building. This helps you avoid problems before your loan becomes permanent.

Construction-Only Loans

A construction-only loan, also called a two time close construction loan, works in a different way. You get a short-term loan just for building. After building, you must get a new loan for permanent financing. This means you close two times, which makes your closing costs higher.

Here is what happens with construction-only loans:

You apply for a construction loan and give your building plans and budget.

The lender checks your credit, income, and project details before saying yes.

Money is given out in steps as building goes on. The lender checks the work before each payment.

You pay interest only on the money you use during building.

When building is finished, you must get a new mortgage for permanent financing. This is the second closing.

If your money changes or rates go up, you might pay more or have trouble getting the new loan.

Construction-only loans can give you more choices for tricky projects. But you do not lock in your permanent rate at the start. You also might have to qualify again for the new loan after building. This can be hard if your money changes or if the property value drops.

Note: Two time close construction loans can be good if you want more control over your final loan or if your project needs special rules.

Pros and Cons

Construction-to-Permanent Loans

If you pick a construction-to-permanent loan, you get some good things that make your project easier. Many people like these loans because they put the building and mortgage together in one package.

Pros:

You only have to close once for both loans. This saves you time and money.

You can lock your interest rate before building starts. This keeps your rate safe if rates go up.

You only need one credit check and less paperwork. This makes things less stressful.

The loan turns into a regular mortgage when building ends. You do not have to apply again or worry about qualifying.

Many people think this loan is simple and easy to use. It fits what most people want today.

Lenders often give better help with these loans. This can make people happier and tell others about it.

Cons:

You usually need a high credit score and a bigger down payment.

Lenders want to see your building plans and budget before you start.

If you spend too much while building, you cannot get more money from this loan.

You may not be able to change your project much during building.

Tip: If you want things to be simple and do not like surprises, a construction-to-permanent loan can help you finish your project.

Construction-Only Loans

Construction-only loans are different. These loans only pay for building. You need a new mortgage after building is done. This loan gives you more choices while building, but it can cost more and be risky.

Pros:

You might have more choices while building, especially if your project is special.

You can look for a better mortgage rate after building is done.

Some lenders let you pay a smaller down payment for these loans.

Cons:

You pay closing costs two times, once for each loan.

These loans have higher interest rates than normal mortgages. Lenders think these loans are riskier.

You must get a new mortgage after building. If your money changes, you might not get approved.

You need two appraisals, which can be a problem if the second one is lower.

Lenders often want a big down payment, sometimes 20% or more, which can be hard to save.

You must pay interest during building and also pay for where you live now.

Getting approved is hard. You need to show your plans, timeline, and budget.

Lenders may want you to keep extra money for surprise costs.

Lots of inspections can slow your project if there are delays.

Changing your builder or loan terms during building is hard and needs the lender to say yes.

Note: Construction-only loans can be good if you want more control or if your project needs special rules, but you will have more paperwork and higher costs.

Loan Fit

For Simplicity

If you want a simple process, a construction-to-permanent loan can help you. You only close once, and your loan turns into a regular mortgage after construction ends. You do not need to worry about getting a second loan or paying closing costs twice. Many people who build a new home or start a large construction project choose this option. You make interest-only payments during construction, which can lower your costs while you build. This loan works well if you want to avoid extra steps and paperwork.

Tip: Choose this loan if you want to keep things easy and avoid surprises.

For Flexibility

If you need more control over your project, a construction-only loan gives you options. You can shop for a better mortgage rate after construction finishes. This loan works well if you think your finances will improve or if you want to sell the home soon after building. Real estate investors often use this type of loan. You must handle two closings and more paperwork, but you get more choices for your final mortgage.

You can use this loan if you have funds to cover construction costs.

You can manage the process if you do not mind extra steps.

For Complex Projects

Some construction projects need special rules or have unique needs. If your project is complex, a construction-only loan may fit better. You can adjust your plans as you build. This loan lets you work with different lenders or change your financing if needed. You must be ready for higher costs and more steps, but you get the freedom to handle a tricky construction project.

For Strong Financials

If you have strong credit, steady income, and a large down payment, you can qualify for either loan. Many people with strong finances pick construction-to-permanent loans because they want a smooth process. You can lock in your rate early and avoid the risk of not qualifying for a second loan. If you want to take on more risk for possible savings, you can choose a construction-only loan.

Note: Think about your goals and how much risk you want to take before you pick a loan.

2025 Considerations

Interest Rates

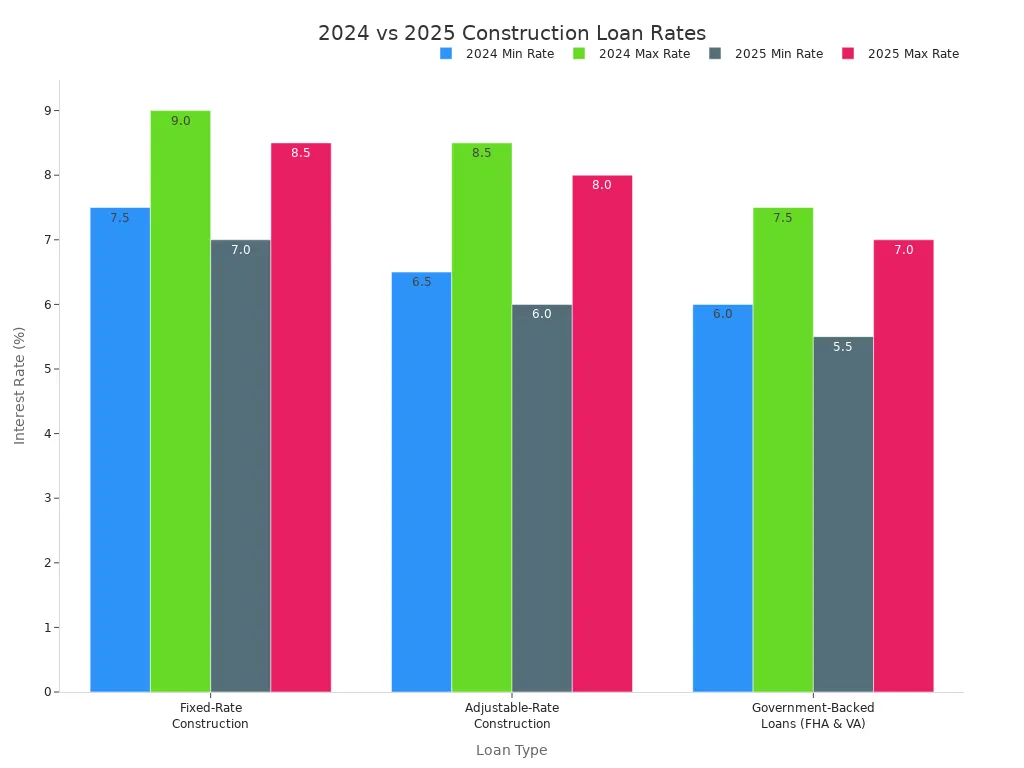

Interest rates for construction loans in 2025 will likely stay the same or go down a little from 2024. The Federal Reserve thinks the federal funds rate will be about 3.9% in 2025. This helps keep the cost of borrowing steady for both construction and permanent loans. Lower rates make it easier to plan your project and pay your loan when it becomes permanent.

Loan Type | 2024 Interest Rate Range | 2025 Projected Interest Rate Range |

|---|---|---|

Fixed-Rate Construction | 7.5% – 9.0% | |

Adjustable-Rate Construction | 6.5% – 8.5% | 6.0% – 8.0% |

Government-Backed Loans (FHA & VA) | 6.0% – 7.5% | 5.5% – 7.0% |

Lower interest rates in 2025 can help you save money on both construction financing and permanent financing.

Lending Environment

There are some important things to know about getting a loan in 2025:

Inflation should get better but will still be higher than before the pandemic, around 4%.

Building costs might go up by 5-7% because materials cost more and there are not enough workers.

Banks think their rules for giving construction loans will stay the same or get a little easier.

Lower interest rates can help more people build and make it cheaper to get a regular loan later.

Many builders use new technology and smart ways to buy things to save money and keep projects moving.

You should plan for higher costs, but it may be easier to get a construction loan or a regular loan.

Regulatory Changes

There will not be big new rules for construction loans in 2025. Fannie Mae’s rules for single-closing construction-to-permanent loans let you change some loan details before or when your loan becomes permanent. If building costs go up, you can ask for a bigger loan, but you need to show proof. The lender will check your loan again if you change anything before it becomes permanent. Most banks think their rules will stay the same or get a little easier because the economy is better and there is more competition. No big rule changes are coming, so you can focus on picking the best loan for your project.

How to Choose

Assess Your Project

Start by looking closely at your project. Think about how simple or complex your build will be. If your project is straightforward and you want less paperwork, a construction-to-permanent loan may fit best. For projects with many changes or special needs, a construction-only loan gives you more flexibility. Ask yourself if you want to lock in your interest rate now or if you want to shop for rates after building. You should also check your credit score and make sure you have enough money for a down payment and extra costs.

Tip: Always set aside a contingency fund—about 15% of your project cost—to cover surprises.

Compare Loan Features

Use a side-by-side comparison to see which loan matches your needs. Here is a quick table to help you:

Evaluation Factor | Construction-to-Permanent Loan | Construction-Only Loan |

|---|---|---|

Number of Closings | One | Two |

Flexibility | Less flexible | More flexible |

Costs | Lower overall | Higher overall |

Rate Lock | Yes | No |

Best For | Simplicity, cost savings | Complex projects, flexibility |

When choosing the right loan, look at the timing of closings, payment structure, and how easy it is to manage the loan. Construction-to-permanent loans save time and money. Construction-only loans let you shop for better rates later.

Questions for Lenders

Before you decide, prepare questions for your lender. Here are some important ones:

What credit score do I need for each loan type?

How much down payment is required?

Can I lock in my interest rate now?

What are the total closing costs?

How does the draw schedule work?

What insurance do I need?

How do you handle changes in project costs?

Meeting with a loan officer helps you understand your options. Bring your project plans, budget, and builder details. Ask about all fees and steps. Choosing the right loan becomes easier when you know what to expect.

Picking between construction-to-permanent and construction-only loans depends on your project and money. You need to look at the good and bad things about each choice:

Construction-to-permanent loans have just one closing. They cost less and protect you if rates go up.

Construction-only loans let you change more things. But you have to close two times and might pay more.

Pros | Cons | |

|---|---|---|

Construction-to-Permanent | One closing, rate lock, easy process | Need better credit and more money |

Construction-Only | Flexible, more lender choices | Two closings, extra paperwork |

You can use websites and lender tools to check your choices. For the best help, talk to a loan officer or money expert who knows about loans in 2025.

FAQ

What credit score do you need for a construction-to-permanent loan?

Most lenders want you to have a credit score of at least 680. Some may ask for a higher score. A better score can help you get a lower interest rate.

Tip: Check your credit before you apply. Fix any errors to boost your score.

Can you use land you already own as a down payment?

Yes, you can use the value of your land as part or all of your down payment. The lender will check the land’s value with an appraisal.

What happens if your project goes over budget?

You must pay extra costs out of pocket. Lenders will not increase your loan amount after closing. Plan for surprises by saving extra money before you start.

Do you pay interest during construction?

You pay interest only on the money you use during construction. Payments start small and grow as you take more draws from the loan.

Can you switch builders after you start construction?

You can change builders, but you must get approval from your lender. The lender will review the new builder’s experience and check your project plans again.

See Also

Understanding How Construction Loans Help Build Homes

Using California Loans To Finance Your Dream Home

A Look At Current Trends In California Construction Loans

How To Select The Ideal Builder For Steele Homes 2025

Deregulation Driving The Recent Growth In Construction Loans